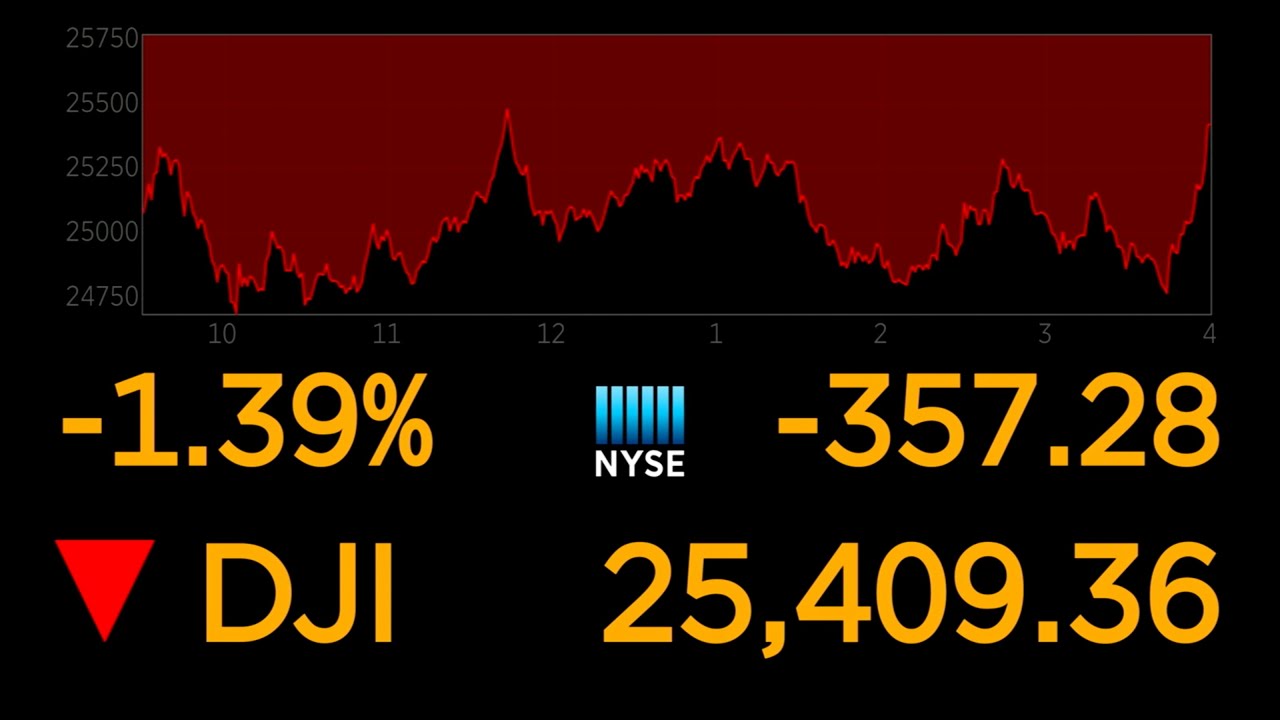

US stock markets continue to plunge over coronavirus uncertainty

US stock markets continue to plunge.

The Dow is suffering its worst week since the financial crash of 2008.

What are some measures that investors can take to navigate the uncertainty caused by the outbreak?

In recent weeks, the coronavirus outbreak has been causing significant uncertainty in financial markets around the world. The US stock market has seen a slew of steep losses, with the Dow Jones Industrial Average plummeting by over 1,000 points on Monday.

The outbreak started in Wuhan, a city in China’s Hubei Province, and has since spread to several other countries, including the United States. As cases of the virus continue to rise, investors have grown increasingly concerned about the global economic impact of the outbreak. The US stock markets have been particularly vulnerable, with the uncertainty leading to a sharp decline in stock prices.

Investors are worried about how the virus could affect supply chains, manufacturing, and consumer spending, as well as how it could impact the travel and tourism industry. Many companies have warned that they will not meet their profit goals as a result of the virus, leading to widespread panic among investors.

Adding to the uncertainty is the fact that the situation is constantly evolving. The World Health Organization has declared a global health emergency, and while some countries have closed their borders to travelers from China, others have kept them open. The US government has also instituted travel restrictions and screenings, but it remains unclear how effective these measures will be in containing the spread of the virus.

Adding to the financial turmoil is the fact that the US economy was already facing some challenges prior to the outbreak. The ongoing trade war with China has led to increased tariffs, which have hurt many US businesses. Additionally, the unemployment rate has been creeping up, and many people are worried about a potential recession.

While it is impossible to predict exactly how the stock markets will react to the coronavirus outbreak over the long-term, it is clear that things are likely to remain volatile in the near future. Investors must navigate this uncertainty carefully, keeping an eye on the latest developments and making wise decisions based on the best available information.

Despite the current negative outlook, however, there is some hope for the future. If the outbreak can be contained and a vaccine developed, the stock markets could quickly rebound. It is also worth noting that historically, the US stock markets have always recovered from short-term dips, even in the face of significant crises.

Therefore, it is important for investors to keep a cool head and not make any rash decisions based on fear or panic. Instead, they must evaluate the situation carefully, plan for the long-term, and make informed decisions based on a thorough understanding of the risks and opportunities involved.

Several states imposing stricter coronavirus restrictions as infections continue to spike

Trump continues to put pressure on the Fed to lower rates

Inside Pro-Trump Women’s Group ‘Trumpettes USA’

Brexit: UK’s new PM accused of pursuing ‘no-deal’ – BBC News

More schools are shutting down due to coronavirus